http://www.appraisersinbatonrouge.com/ – Baton Rouge Real Estate in October 2009 Ranks Within The 20 Strongest Metro Areas In U.S.

(NOTE: This Photo, Taken in 10/2009, Shows New Construction By More “Economy Builders” Priced Below $200,000 Is Still Fairly Brisk Within The Outlying Areas Of Greater Baton Rouge Itself. This is the “New” New Construction Baton Rouge housing market, a market that is much more affordable in pricing. And, this is what is selling. Some of those builders that thought buyers would just keep paying $136/sf to $160/sf and never stop are the ones still holding inventory, paying interest and their banks are sometimes taking it on the chin. In new home construction, in general, under $200K is moving fairly well; Over $250K is Still Not Selling As Fast As It Did in 2006/2007. AND, these $200,000 new homes in the photo are being built in a “former” high end subdivision where the predominant values were $350,000 or about $135/sf. The new price per sq. ft. for the remaining 85% of lots is going to be in the $96/sf to $106/sf. OUCH!!!)

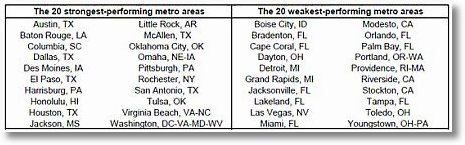

Mark Perry, with Wall Street Pit Global Market Insight, is reporting, along with Business Week, that Baton Rouge Real Estate in 2009 is within THE 20 Strongest Performing Metro Areas in the U.S.. The link to the article is here. A Snippet includes:

“BUSINESS WEEK (”The U.S. Metros Least Touched by Recession”) – America’s strongest economies have one thing in common — home prices that never got too hot or too cold (see charts above comparing the home price index in California to Arkansas, Texas and Oklahoma over the last ten years).

Home prices in metros such as San Antonio, Oklahoma City, Pittsburgh, Rochester, Little Rock, Ark., and Baton Rouge, La., remained steady through boom and bust. Although no metropolitan area entirely avoided the economic downturn, the most resilient metros were protected by a potent mix of recession-resistant jobs.

The upstate New York areas of Syracuse, Rochester, Albany, and Buffalo suffered from declining jobs in manufacturing, but got significant boosts from sizable health-care, education, and government sectors. Construction is booming in Baton Rouge, Louisiana’s capital, as firms take advantage of financing for post-Katrina hurricane recovery work and service-related companies expand to meet the needs of a growing population. Omaha and the state of Iowa have relatively strong insurance sectors.

Texas, the last state to enter recession, has been bolstered by its oil and gas industries — which have also helped Oklahoma, North Dakota, and Louisiana. Texas also has many other things going for it, including affordable home prices and relatively low wages, which attract corporations.”